11/03/2024

While most understand that gambling means the house always wins, it’s less known that 90% of retail traders fail to be profitable on a yearly basis. According to Investopedia, retail traders are “individuals who buy or sell securities with money from personal wealth, rather than for an institution”.

The reality is the retail trading infrastructure is set up for people to fail. Self-described trading educators and charlatan “brokers” are in fact collecting large profits derived from retail trader losses.

In this blog we’ll explore how this happens, who is profiting, and how similar these practices are to those of online gambling affiliates.

Who’s profiting?

Charlatan “trading educators” have found it highly lucrative to sell online courses, teaching consumers terrible trading strategies, which if followed, will result in people trading their accounts to zero.

Trading educators often have no knowledge of professional trading. Typically their experience is in digital marketing, which enables them to sell their courses. You will almost certainly spot lifestyle messaging in their promotional content. For example, “Follow these steps and you will own a car like mine”. In fact, most of these individuals don’t own these cars, they simply rent them to pretend on social media. Similarly, posts that show them “travelling” by private jet are always staged, utilising promotional shoot locations.

If they’re bad at trading, how do the educators

end up making a profit?

In every country where there is financial regulation, licensed brokers are required by their regulator to have an ‘Introducing Broker’ (‘IB’) agreement in place. This is an agreement between any individual or company that ‘introduces’ individuals to their trading platform.

There are jurisdictions where anyone can become an Introducing Broker, without any special certification. Although some markets, such as Australia, South Africa and the United States require some certification for Introducing Brokers.

These IB agreements typically include payments for the educator based on the size and frequency of an introduced client’s trading activity, such as spread and commission on trades.

Outside of the United States, IB Agreements rebate “educators” between 20-50% of the spread + commission paid by an introduced individual to the trading platform, back to the “educator”.

A minority of IB Agreements also rebate the “educator” a percentage of any finance charges paid by the client to the trading platform.

This is clearly a huge conflict of interest. The “educators” are incentivized to encourage overtrading and increased position size, as this generates them the most profits in payments from the trading platform.

There are clear similarities between this and online gambling affiliates who generally make a percentage of a referred individuals’ losses to any gambling site, sometimes more than 50% of the total losses from that account in perpetuity.

The rise of “Day Trading” and “Technical Analysis Courses” can in part be attributed to this conflict of interest amongst market participants. The strategies taught by false “educators” typically applies very rudimentary knowledge. Technical analysis, for example, involves following lines on a chart. Teaching people with a lack of financial education something they believe they can understand can feel empowering to them. But this opens the door to much greater risks.

One reason gamblers may continue to gamble in the face of sustained losses is due to the illusion of control. Gamblers may persist in the belief that they have special skills or knowledge that enable them to gain an advantage, which convinces them to keep going. When reflecting on a gambling session, a gambler may focus on a particular moment that doesn’t threaten but instead supports their notion that they’re able to find patterns in random events. Similar mechanisms are in play when it comes to trading and following lines on charts.

“Technical Analysis” may form a small part of an overall system that a professional trader would employ, but it wouldn’t be enough to warrant making a trade on its own.

Professional traders do not typically “Day Trade”, except in certain market conditions. “Day Trading” is normally carried out by algorithms trading several times per second and even these tend to become obsolete relatively quickly or “machined out”. This is the process whereby the algorithm stops working effectively due to market forces.

Gary Stevenson, a former professional trader for Citibank, told The Times: “I was one of the most successful and best-paid traders in the world and I don’t day trade. It’s roulette.”

“The people at home think they are the Wolf of Wall Street. But traders in the City are, in general, not taking bets on the short-term future of the market because there’s no way you can predict the movement. It’s impossible.”

Note: In the US, an “educator” cannot receive a percentage rebate unless they are fully regulated as a broker, however nonregulated educators can receive flat payments for client introductions to the broker. These payments can be significant, and the broker is only willing to pay them due to the huge amounts of money they are making from loss-making traders.

Did you know?

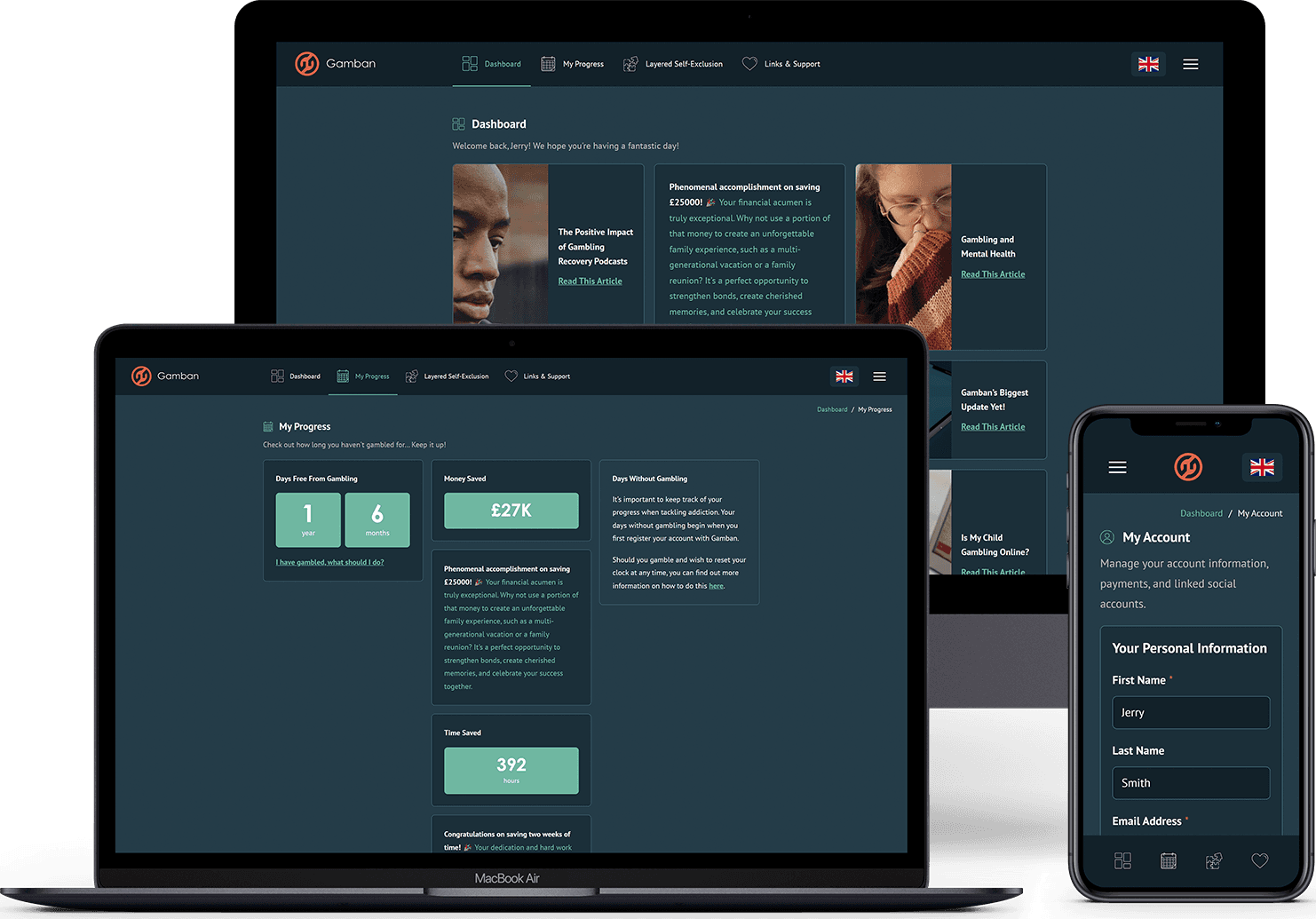

Since September 2021, Gamban’s blocking software has blocked access to all known “Trading Platforms”, including “Crypto” trading and “Non-Fungible Tokens” (NFT) trading platforms. Many individuals that are trading and losing money after having followed an online course are not aware that they are gambling.

Our co-founder Matt Zarb-Cousin spoke to Gary Stevenson about the difference between investing strategies and speculating, and how new forms of gambling have emerged that masquerade as financial products. The full video is here.

Are you able to help a friend or loved one who may be affected by this? Always speak with a professional. If you’re in the UK, you can speak with the National Gambling Helpline for free and confidential advice.

For resources available in your region please check out our get help page.